VSLAs - building peer-to-peer networks to strengthen financial resilience

VSLAs: What are they?

Voluntary Savings and Loans Associations

Reason for creation?

Despite the increased income of artisanal miners compared to their peers in sectors such as agriculture, they are still poverty-stricken due to the mismanagement of their resources and the lack of financial education. Voluntary Savings and Loan Associations (VSLAs) are designed to support communities, mine workers and disadvantaged people to save more efficiently and to help build solidarity among members while providing a safety net against predatory lending in the community.

How do they work?

The FCA partnered with a local NGO, Alternatives for Action (AFA), to execute a programme aimed at raising the financial literacy and resilience of the local mining community as well as providing an opportunity for the members to venture into alternative livelihoods.

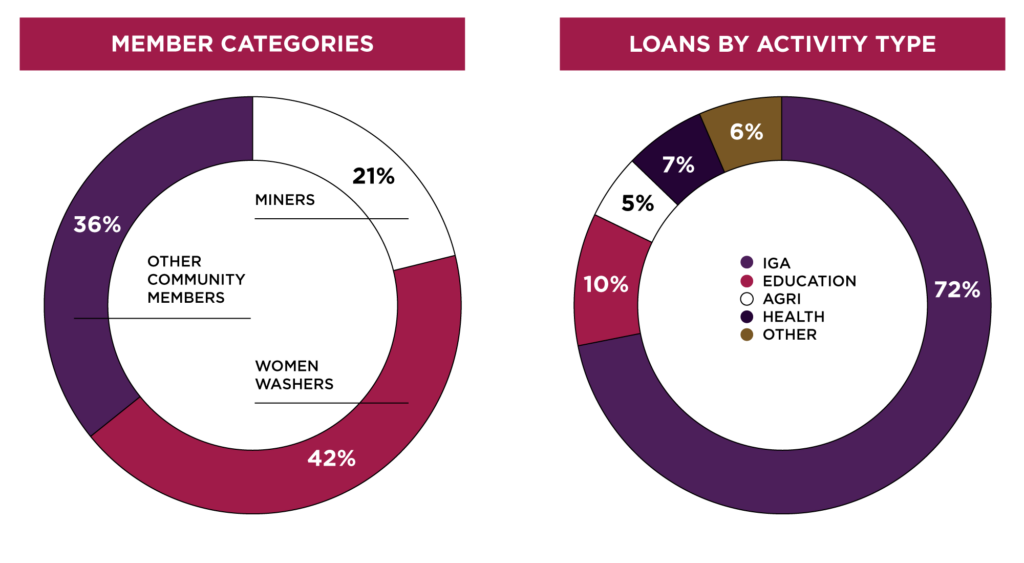

Launched at the start of 2022, the A.F.A set up 14 savings groups reaching as many as 350 mining community members in Kamilombe. The groups convene weekly for the financial management of their joint savings and the social emergency fund and receive training on financial accounting and small-scale entrepreneurship.

The members pool their savings and pay according to their means. Keeping track of how much each individual has contributed, the resulting funds are used to provide micro-loans to interested members of the groups at a competitive interest rate, which has to be repaid within 4 weeks. All transactions are subject to oversight by a small committee of 5 people chosen amongst the members and governed by their internal regulations. Each saving cycle lasts 9 months, at the end of which all the funds and profits accrued are distributed to the members in proportion to how much they originally contributed.

The regular meetings structure introduced by the VSLAs will continue to exist beyond the duration of the project.

Results

VSLAs by the numbers and testimonials

VSLAs by the numbers and testimonials

At the end of the first cycle of the VSLAs, the overall feedback from the participants was extremely positive. Mama Angeline, a member of the Jerusalem savings group, said

“I am married and a mother of ten children. Since this movement (savings group) arrived in Kapata, it has helped me a lot. Nothing worked in my house. I was suffering. But since I started saving money through this organisation, the suffering is gone. I am no longer in debt. My house has got back on its feet, and love has returned to my house. My children can study. I thank the initiators of these savings groups.”

To close off the year, a 2022 closing ceremony was held to celebrate the tremendous success of the first cycle of savings, distributing the funds and profits among members.

This is an excerpt from the FCA 2022 Annual Impact and Finance Report published in February 2023. The report shows, for the first time, case studies highlighting specific projects run by the local team in Kolwezi, in partnership with our local and international partners.